WASHINGTON, D.C., 02/10/2022 – Wine & Spirits Wholesalers of America’s (WSWA’s) SipSource released today the latest set of Channel Shifting Index (CSI) data that provides wine and spirits professionals access to channel performance data for wine and spirits categories/segments, price tiers, and U.S. regions that are easy to understand and relevant to navigate the challenges that COVID and other headwinds are continuously throwing at the industry.

WSWA’s SipSource is the most comprehensive source for channel performance and shifts—based on distributor depletion data across both off- and on-premise channels and sub-channels, at a national and U.S. Census division level.

The Latest SipSource CSI Tells Us:

“The on-premise CSI has improved significantly since its low point (12 months to February 2021), but still has a ways to go to get back to where it was pre-COVID,” said Danny Brager, SipSource analyst and industry veteran. “The combined wine and spirits CSI for on-premise reached 81 for the 12 months ending December 2021, versus 45 at its low point—obviously a sign of the channel’s longer-term recovery from COVID-related impacts,” Brager added. “But stubbornly, the on-premise share remains well below where it was pre-COVID, with wine’s rate of recovery (a CSI of 75) still well below spirits (a CSI of 83).”

However, Brager cautioned that this doesn't necessarily mean that the overall category is performing poorly, as total category performance is based on on- plus off-premise, not one or the other. Contributing factors behind on-premise’s steady improvement include:

- There are thousands of on-premise locations not in business any longer, and thousands of others facing significant labor shortages and cost concerns leading to shorter hours for some, or even closures for a part of the week for others.

- There is still some consumer hesitancy to go out—exacerbated during each of the COVID waves and variants over the past year (first Delta, then Omicron). That is more likely to impact older age groups, and one of the reasons among others why wine’s on premise recovery might be lagging, since the core wine-consuming generations are Boomers and Seniors.

- During the COVID lockdowns, consumers became quite used to purchasing their adult beverages in stores or online, and drinking them at home. They've experienced months and months of their COVID routines and getting back to what they used to do might take some time.

- As COVID (hopefully) wanes and as we approach warmer months with more outdoor possibilities, we expect the on-premise to make further improvements in its share, and adjoining CSI.

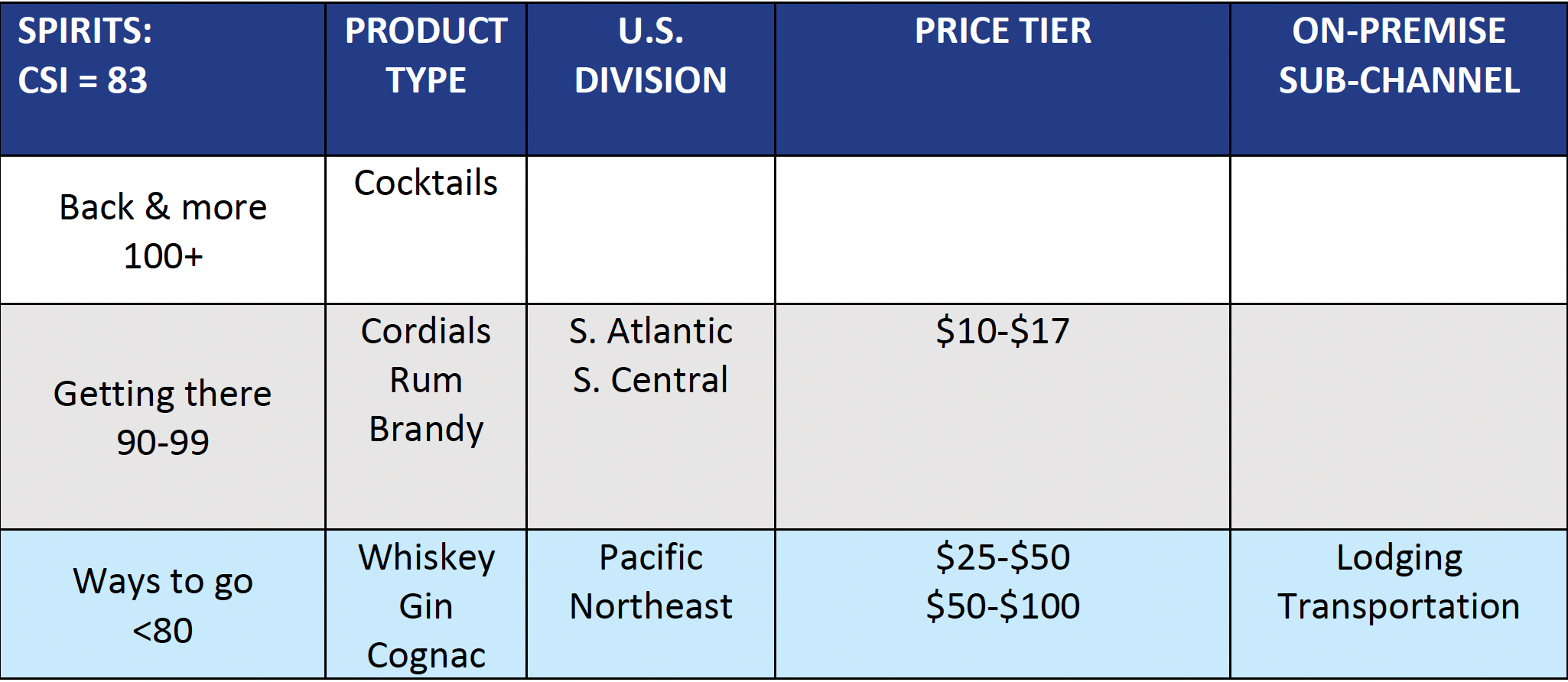

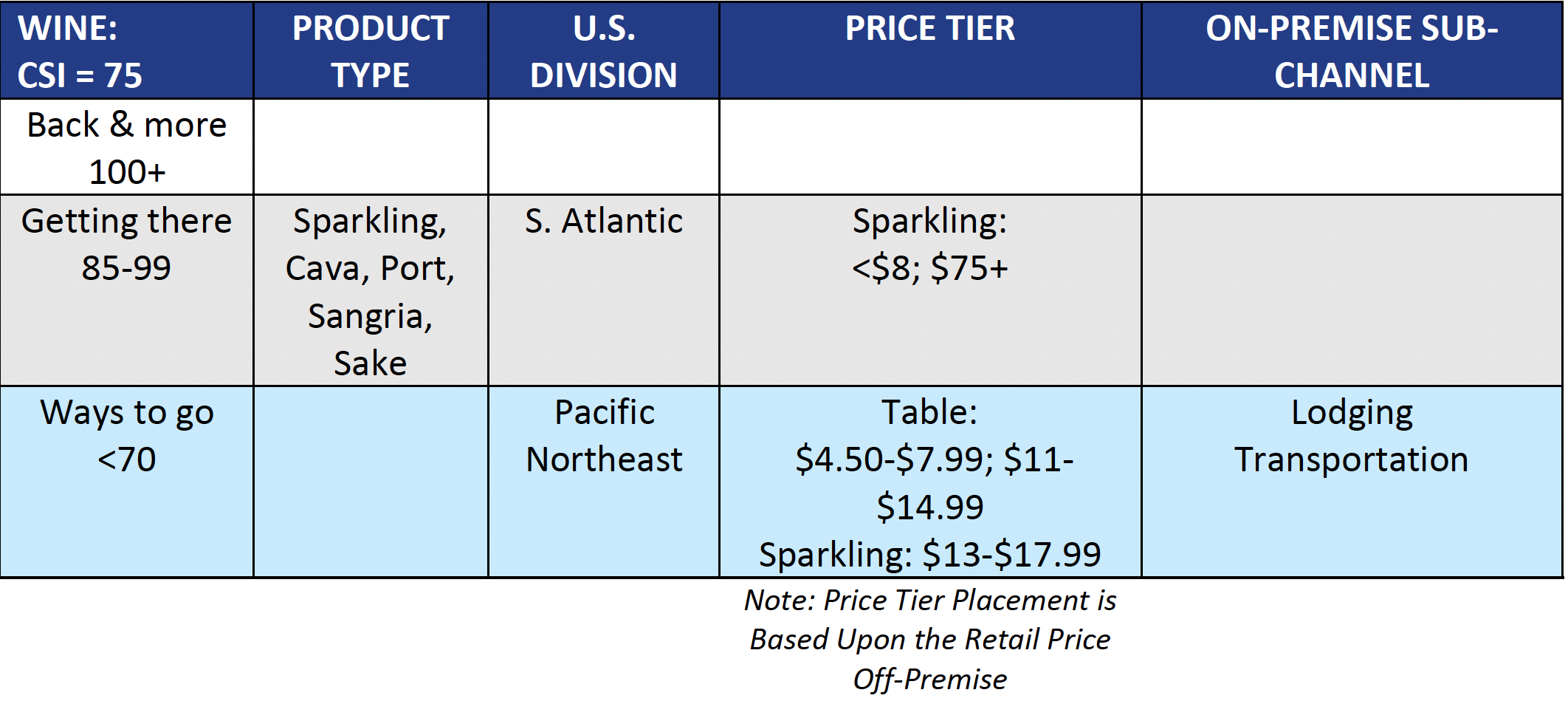

Specific wine and spirits product types, price tiers, regions, and on-premise sub-channels are recovering at different rates. The chart below highlights those that are recovering the fastest and slowest relative to the overall spirits and/or wine categories, with all others somewhere in the middle.

Current On-Premise Share (12 Months to December 2021)

Compared to Pre-Covid (12 Months to February 2020) = 100

The ONLY segment to have now achieved a greater on-premise share than pre-COVID are spirit-based ready-to-drink cocktails (RTDs). RTDs had a CSI of 171 for the last 12 months, and close to 200 in just the past three months, which indicates the on-premise share of this segment has now almost doubled since pre-COVID. The growth reinforces the increasing popularity of pre-mixed cocktails and RTDs, which exploded first in off-premise, but is now seeing more consumer and operator popularity on-premise.

Among other notable CSI highs and lows, the on-premise recovery has been weakest in both the Pacific and Northeast areas of the country, and best in the South Atlantic and South Central for spirits, and just the South Atlantic for wine.. At the on premise sub-channel level, recovery of both Lodging and Transportation channels – while both better than earlier in 2021, are still lagging other on-premise channel types. Of the two, Transportation is the weakest due to reduced levels of travel and likely as a result of decisions taken by some airlines to not offer alcohol inflight, at least for the time being.

How to Read WSWA’s SipSource CSI Index:

The SipSource CSI provides monthly comparisons of channel importance to pre-COVID levels (12 months to February 2020). An index above 100 indicates the channel referenced has a greater share of the market than it had pre-COVID; an index less than 100 indicates that the channel has a smaller share of the market than it had pre-COVID. In particular, on-premise business was devastated during the height of the pandemic and is now in various stages of recovery. But wine and spirits are not recovering equally—nor are the segments within each category, the regions within the country, or the various trade sub-channels.

This data will enable you and your teams to answer the unknowns such as:

- Where should you focus/invest? Where should you hold back?

- Are you keeping pace with overall category/segment trends in various channels?

For members of the media who wish to discuss CSI data with a SipSource analyst, please contact Michael@WSWA.org.

For professionals interested in subscribing to this SipSource data set, please contact Nicole@wswa.org.

About SipSource by WSWA

Wine & Spirits Wholesalers of America’s (WSWA’s) SipSource is the ONLY source for aggregated distributor depletion data, built from unique items sold to individual stores. Since wholesalers distribute to all types of retailers, SipSource has unrivaled channel segmentation. It also covers the largest volume of bona fide alcohol sales and does not need to rely on estimates, samples or projections. WSWA’s SipSource uses an industry leading platform: VIP’s iDIG to deliver timely, transparent and trusted data. In addition to the reporting tool, subscribers have access to quarterly and annual reports that leverage powerful collaboration with industry leaders and provide high-level insights into the wine and spirits marketplace.

###