WASHINGTON, D.C., 08/11/2022 — Wine & Spirits Wholesalers of America’s (WSWA’s) SipSource released today the latest set of Channel Shifting Index (CSI) data that provides wine and spirits professionals access to easy-to-understand channel performance data for wine and spirits categories/segments, price tiers, and U.S. regions that are relevant to successfully navigate the current market environment.

WSWA’s SipSource is the most comprehensive source for channel performance and shifts based on distributor depletion data across both off- and on-premise channels and sub-channels at national and U.S. census division levels.

The Latest SipSource CSI Tells Us:

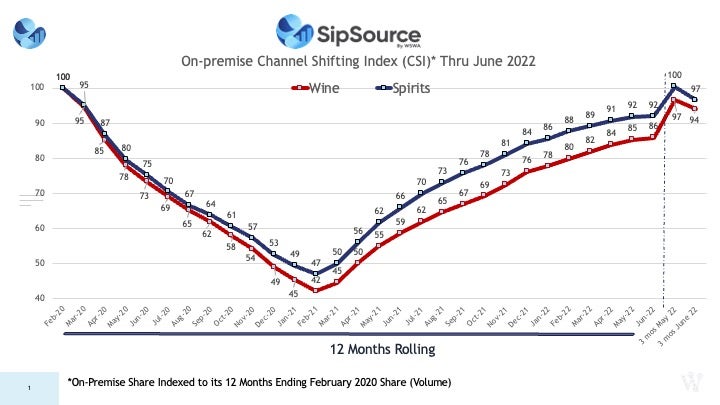

After many consecutive months of improvement in the CSI as the on-premise recovered from the negative impacts of COVID, the CSI fell back somewhat in the most current three months through June compared to what we saw in the three months through May — to 97 for spirits (from 100), and to 94 for wine (from 97). The on-premise consists of channels such as restaurants, bars/nightclubs, lodging, recreation, and transportation.

“It is hard to tell whether this reversal is a result of the very transmissible COVID virus and rise in cases — thankfully, less severe cases generally — or consumer belt tightening due to broader impacts of inflation. It could very likely be a combination of the two,” said Danny Brager, SipSource analyst and industry veteran. “It’s possible that inflation in critical sectors such as gas and food may be slowing on-premise visits. At the same time, though, wine and spirits volumes for the last three months continue to grow compared to where we were last year (+5.3% for wine and +9.5% for spirits),” added Brager.

Looking at the big picture, the on-premise is in much better shape overall compared to last year, with spirits continuing to outperform wine.

While the CSI for most wine and spirits product segments retreated from prior month levels, there were some notable exceptions:

- The importance of on-premise to the exploding ready-to-drink (RTD) cocktails category continued to grow, and this channel now represents 10% of spirits RTD’s overall volume — more than double its pre-COVID importance. Compared to most other spirits categories, 10% is still relatively small, but it demonstrates that the on-premise can participate in this growth segment too.

- Not all on-premise channels behaved similarly. With many consumers resuming their leisure and/or business travel and airlines resuming their beverage alcohol service, the importance of the transportation channel for wine grew, though still below pre-COVID levels. For spirits, it was the recreation channel within the on-premise that expanded further, and its CSI is comfortably ahead of pre-COVID levels.

- While the importance of the on-premise to sparkling wine declined somewhat from where it was in May, its CSI index remains above 100. With about 28% of all sparkling wine in the on-premise over the last three months, it’s almost two points higher than its pre-COVID share.

“Is this just a temporary speed bump, or something that may be longer lasting? That’s the big question we’re asking now,” said Brager. “If consumers are cutting back on eating and drinking out, will that potential lost wine and spirits business transfer back to the off-premise? If that’s not the case, it could spell trouble,” Brager added.

How to Read WSWA’s SipSource CSI Index:

The SipSource CSI provides monthly comparisons of channel importance to pre-COVID levels (12 months to February 2020). An index above 100 indicates the channel has a greater share of the market than it had pre-COVID; an index of less than 100 indicates the channel has a smaller share of the market than it had pre-COVID. Note that CSI rankings compare relative market shares, and not overall sales/depletion volumes. This data will enable you and your teams to answer questions, such as:

- Where should you focus/invest? Where should you hold back?

- Are you keeping pace with overall category/segment trends in various channels?

For members of the media who wish to discuss CSI data with a SipSource analyst, please contact Michael Bilello (michael@wswa.org). For professionals interested in subscribing to this SipSource data set, please contact Nicole Anderson (nicole@wswa.org).

About SipSource by WSWA

WSWA’s SipSource is the only source for aggregated distributor depletion data, built from tracking unique items sold to individual stores. Since wholesalers distribute to all types of retailers, SipSource has unrivaled channel segmentation. It also covers the largest volume of bona fide alcohol sales and does not need to rely on estimates, samples or projections. WSWA’s SipSource uses an industry-leading platform, VIP’s iDIG, to deliver timely, transparent and trusted data. In addition to the reporting tool, subscribers have access to quarterly and annual reports that leverage powerful collaboration with industry leaders and provide high-level insights into the wine and spirits marketplace.

###