WASHINGTON, D.C., 06/30/2022 – Wine & Spirits Wholesalers of America’s (WSWA’s) SipSource released today the latest set of Channel Shifting Index (CSI) data that provides wine and spirits professionals access to channel performance data for wine and spirits categories/segments, price tiers, and U.S. regions that are easy to understand and relevant to successfully navigate the current environment.

WSWA’s SipSource is the most comprehensive source for channel performance and shifts —based on distributor depletion data across both off- and on-premise channels and sub-channels at the national and U.S. census division levels.

The Latest SipSource CSI Tells Us:

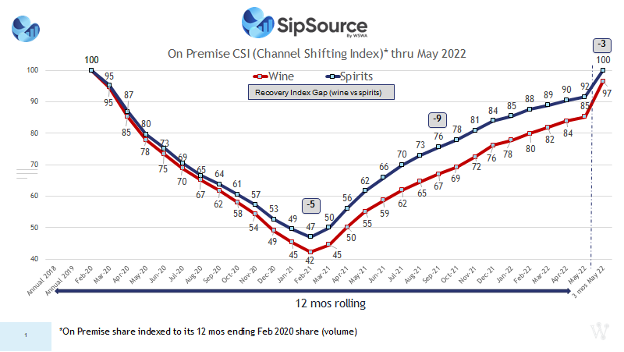

The spirits CSI index of 100 indicates that for three-months ending May 2022, the on-premise share of the spirits category is now in line with its share pre-COVID. While wine’s CSI of 97 is lagging somewhat, it still represents a steady and significant improvement. The on-premise consists of channels such as Restaurants, Bars/Nightclubs, Lodging, Recreation, and Transportation.

“This is telling us that overall, consumers are getting back to pre-COVID norms in terms of the proportion of their buying and consumption of wines and spirits occurring off-premise versus on-premise” said Danny Brager, SipSource analyst and industry veteran. “Living with COVID appears to largely be the new norm,” he added.

Regionally, the one area that stands out from the others in terms of the pace of on-premise recovery is the South Atlantic (where Florida the largest state) – for both wine and spirits. This region’s on-premise CSI is now above 100 over the last three months.

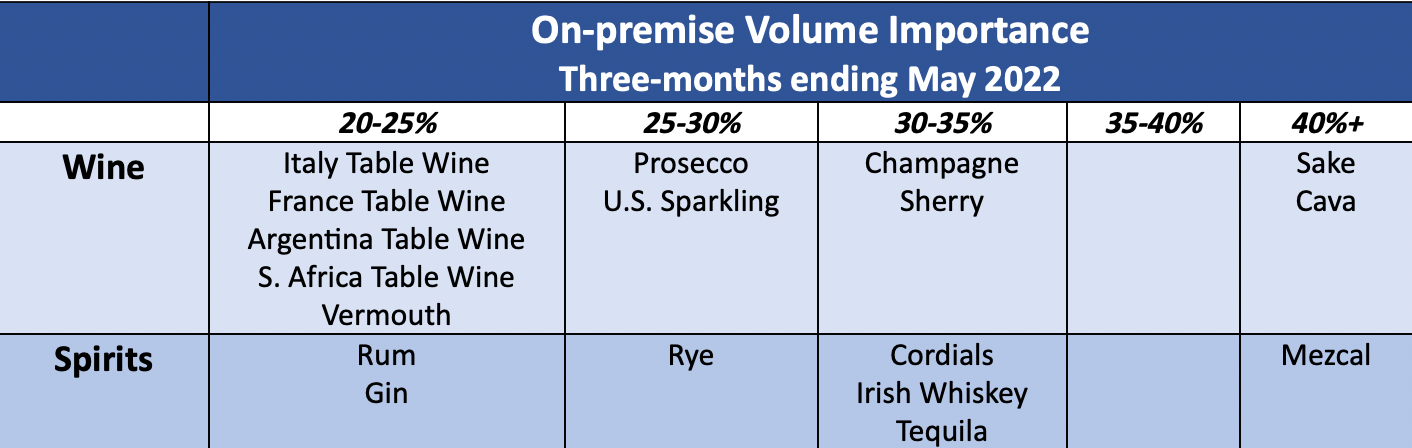

The on-premise recovery is particularly important for brands hoping to introduce themselves to the consumer in a channel long used for new product introductions. This is good news for those products that have traditionally relied on the on-premise channel for a large percentage of its volume. In particular, the segments below derive a minimum of 20 percent of their volume from the on-premise.

While the relative importance of on- and off-premise channels is returning to pre-COVID levels, the spirits category overall continues to perform better than wine – growing faster than wine in the on-premise, and declining less than wine in the off-premise, for the past three months versus a year ago.

“What I’m watching closely now is the impact of inflation on consumer spending patterns as their wallets are squeezed,” added Brager. “Will consumers cut back on eating and drinking out? And, if so, how will that impact wine and spirits?”

How to Read WSWA’s SipSource CSI Index:

The SipSource CSI provides monthly comparisons of channel importance to pre-COVID levels (12 months to February 2020). An index above 100 indicates the channel referenced has a greater share of the market than it had pre-COVID; an index less than 100 indicates that the channel has a smaller share of the market than it had pre-COVID.

This data will enable you and your teams to answer the unknowns such as:

- Where should you focus/invest? Where should you hold back?

- Are you keeping pace with overall category/segment trends in various channels?

For members of the media who wish to discuss CSI data with a SipSource analyst, please contact Michael@wswa.org.

For professionals interested in subscribing to this SipSource data set, please contact Nicole@wswa.org.

About SipSource by WSWA

Wine & Spirits Wholesalers of America’s (WSWA’s) SipSource is the ONLY source for aggregated distributor depletion data, built from unique items sold to individual stores. Since wholesalers distribute to all types of retailers, SipSource has unrivaled channel segmentation. It also covers the largest volume of bona fide alcohol sales and does not need to rely on estimates, samples or projections. WSWA’s SipSource uses an industry leading platform: VIP’s iDIG to deliver timely, transparent and trusted data. In addition to the reporting tool, subscribers have access to quarterly and annual reports that leverage powerful collaboration with industry leaders and provide high-level insights into the wine and spirits marketplace.

###