WASHINGTON, D.C., 03/07/2022 – Wine & Spirits Wholesalers of America’s (WSWA’s) SipSource released today the latest set of Channel Shifting Index (CSI) data that provides wine and spirits professionals insight to channel-performance data for wine and spirits categories/segments, price tiers, and U.S. regions—important data needed to successfully navigate the current environment.

WSWA’s SipSource is the most comprehensive source for channel performance and shifts—based on distributor depletion data across both off- and on-premise channels and sub-channels, at a national and U.S. census division level.

The Latest SipSource CSI Tells Us:

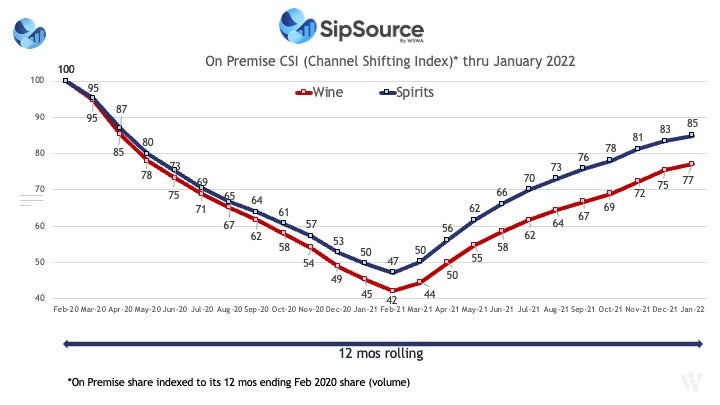

The combined wine and spirits CSI for on-premise reached 82.3 for the 12 months ending January 2022, an improvement versus the 80.7 CSI for the 12 months ending December 2021.

“The on-premise CSI continues to make small gains in most months since its low point back in the 12 months to February 2021 (CSI of 45), and those small gains have added up over time,” said Danny Brager, SipSource analyst and industry veteran.

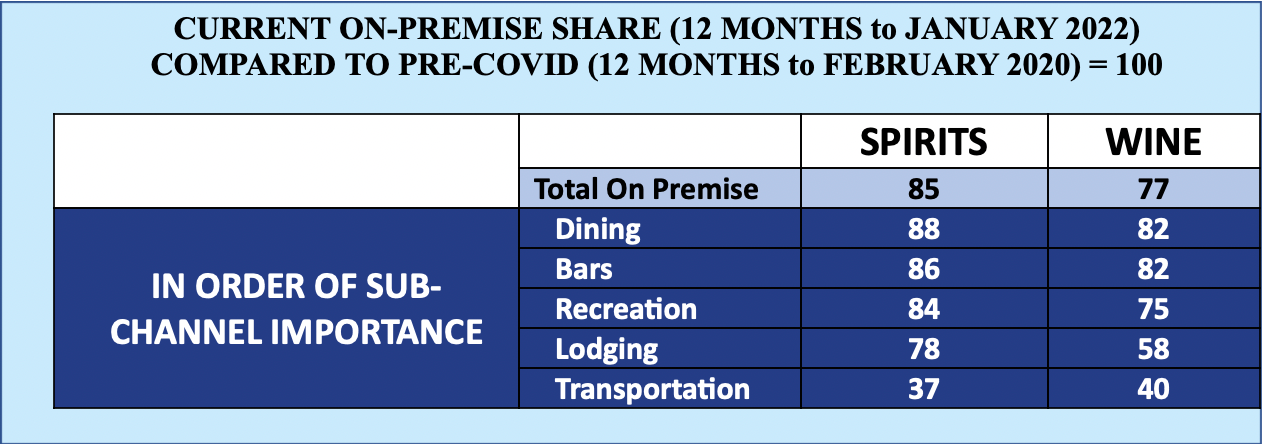

Going a bit deeper, wine’s state of recovery (CSI of 77) still remains well behind that of spirits (CSI of 85).

Brager continued, “The closure of many on-premise locations coupled with reduced hours for others, and the Omicron-variant surge in January all contributed to these CSI numbers still remaining well below the pre-COVID share, albeit steadily improving. As COVID cases fall dramatically and further restrictions and/or guidelines are eliminated, and as we approach warmer months with more outdoor dining possibilities, I expect the on-premise to make further improvements in its share, and adjoining CSI,” added Brager.

Relative to its on premise share pre-COVID, recovery of this channel’s importance has been fastest for the segments below:

Spirits: In spirits, Cordials (CSI of 92), Rum (CSI of 93), Mezcal (91), and Brandy (CSI of 93) stood out in the data.

It’s worthwhile noting that the importance of the on premise to these segments differs widely – for instance, pre-COVID, the on-premise was responsible for almost 50% of Mezcal’s volume, but only six percent of Brandy’s volume.

Beyond those segments, ready-to-drink (RTD) spirits-based cocktails remain a largely off-premise segment, as 93% of its volume is sold in the off-premise. But interestingly, RTD Cocktails (CSI of 165) is the single category where the on-premise is becoming more important now than pre-COVID as a result of its rise in consumer popularity, its convenience to operators, and “drinks-to-go” legalization in several states.

Wine: For wine, it’s more difficult to find standout segments based on the pace of their on-premise recovery. Cava (CSI of 95) and Sangria (CSI of 100) stood out positively but from very different levels of importance. Almost 40% of Cava’s business pre-COVID occurred on-premise versus less than five percent of Sangria’s volume.

Regionally, the pace of recovery is still fastest for the South Atlantic and South Central regions, while the Pacific and Northeast regions continue to trail.

By sub-channel, the CSI for the Dining, Bars, and Recreation channels are much higher than for Lodging and Transportation, the latter are more impacted by reduced levels of travel, as well as decisions taken by some airlines to not offer alcohol inflight, at least for a period of time.

Notably, the Transportation channel is showing signs of recovery now. Looking back 12 months ending January 2022 shows a CSI of 37 for spirits, but viewing just the last three months, the CSI moves up to 44. The same effect occurs in wine, which moves from a CSI of 40 (12 months ending January 2022), up to 49 (three months ending January 2022). So as more Americans travel and COVID restrictions are reduced or eliminated, wine and spirits in the Transportation channel will benefit.

How to Read WSWA’s SipSource CSI Index:

The SipSource CSI provides monthly comparisons of channel importance to pre-COVID levels (12 months to February 2020). An index above 100 indicates the channel referenced has a greater share of the market than it had pre-COVID; an index less than 100 indicates that the channel has a smaller share of the market than it had pre-COVID. In particular, on-premise business was devastated during the height of the pandemic and is now in various stages of recovery. But wine and spirits are not recovering equally—nor are the segments within each category, the regions within the country, or the various trade sub-channels.

This data will enable you and your teams to answer the unknowns such as:

- Where should you focus/invest? Where should you hold back?

- Are you keeping pace with overall category/segment trends in various channels?

For members of the media who wish to discuss CSI data with a SipSource analyst, please contact Michael@WSWA.org.

For professionals interested in subscribing to this SipSource data set, please contact Nicole@wswa.org.

About SipSource by WSWA

Wine & Spirits Wholesalers of America’s (WSWA’s) SipSource is the ONLY source for aggregated distributor depletion data, built from unique items sold to individual stores. Since wholesalers distribute to all types of retailers, SipSource has unrivaled channel segmentation. It also covers the largest volume of bona fide alcohol sales and does not need to rely on estimates, samples or projections. WSWA’s SipSource uses an industry leading platform: VIP’s iDIG to deliver timely, transparent and trusted data. In addition to the reporting tool, subscribers have access to quarterly and annual reports that leverage powerful collaboration with industry leaders and provide high-level insights into the wine and spirits marketplace.

###