WASHINGTON, D.C., 04/18/2022 – Wine & Spirits Wholesalers of America (WSWA)’s SipSource today released its first Price Tier Performance (PTP) Scorecard. The new PTP Scorecard reaches across three-tier compliant on- and off-premise wine and spirits channels and provides access to all categories/segments across different price tiers. The scorecard provides SipSource subscribers access to data and analysis that is necessary to successfully navigate today’s dynamic marketplace and more accurately pinpoint competitive market positioning.

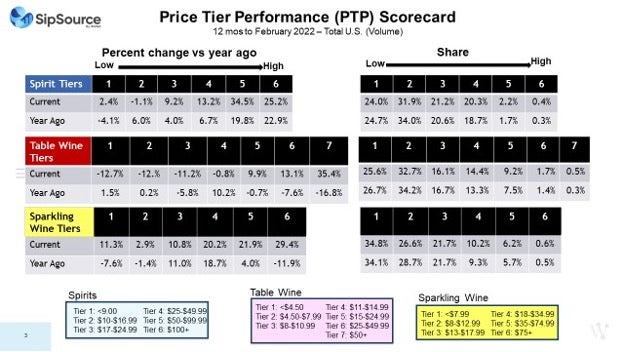

The first SipSource PTP Scorecard analyzes price tier data and trends from February 2021 -2022 versus 2020-2021 and provides analysis of category growth and consumer spending habits, including the impact of inflation on that spending.

The Majority of Volume is Less Than $17 per Bottle, But the Majority of Growth is in Higher Price Tiers

The major differentiator between categories is at the lower end. For spirits, the two lowest price tiers ($9.99 or less and $10-$16.99 per equivalent 750 ml bottle) account for 56% of volume and are relatively stable in terms of growth versus a year ago. For table wine, the three lower price tiers (collectively less than $11 per equivalent 750 ml bottle) account for almost 75% of the category’s volume, while all three price tiers are currently declining at double-digit levels.

“Twelve-month comparisons through February 2022 versus the year prior still include the extreme pantry loading that started when COVID shelter-in-place directives had a significant impact on consumer behaviors,” notes SipSource Analyst Danny Brager. “The pantry loading was highly focused on the lower-end of table wines, and as the comps start to now move beyond that period, it’s likely that volume decreases will begin to moderate. On the other hand, higher-end table wine price tiers declined through most of 2020, creating relatively easier comps for the current 12-month period, so we expect some moderation of the very large growth rates we’re seeing currently. Yet, we expect that the higher end will still be the center of industry growth."

Sparkling Wine Pops over $18

“The sparkling wine PTP Scorecard is a strong one with growth right across the board from the low end to the high end,” said Brager. “However, we anticipate that the current large growth rates at the higher ends we’re seeing will moderate somewhat.” The Sparkling Wine PTP Scorecard shows impressive growth in all categories, but growth above 20% in the top three price-tiers over the past year (February 2021- 2022): Tier 3 ($18 – $34.99): +20.2%, Tier 4 ($35 - $74.99): +21.9%, and Tier 5 ($75+): +29.4%.

Bracing for Impact

Inflationary pressures, as well as expanded spending opportunities for consumers beyond alcohol that were significantly restricted during COVID (e.g., travel, entertainment, recreation, etc.), may have some impact on the level of premiumization seen over the past year.

“Depending on the portfolio of any individual supplier or importer, this represents either a very positive or negative story,” explains Brager. “If you’re operating in a segment and price tier with strong growth, the wind is at your back, and you can assess if you’re keeping pace with the gains, but if you’re operating in a segment and price tier with negative trends, the headwinds could be significant. Yet if you’re growing in that latter case, you have a 'winning/positive' exception that you can leverage to ensure you’re not painted universally in a negative light. It’s critical for brands to determine both the size of the prize and the trend associated with the segments and price tiers they operate within, so that they can assess their relative performance."

How to Read SipSource’s PTP Scorecard

WSWA’s SipSource is the industry’s most comprehensive data source for price tier performance and shifts—based on distributor depletion data across both on- and off-premise channels, at a national and U.S. Census division level and across multiple wine and spirits product categories/segments. The PTP Scorecard provides comparisons of price tier share and volume trends for both the current 12-month period and the year ago 12-month period.

This data will enable SipSource subscribers and their teams to answer unknowns such as:

-

Are you keeping pace with category/segment trends in various channels and geographic areas, within various price tiers?

-

Where should you focus/invest? Where should you hold back?

“While only high-volume category results are reported here, the real magic and application is drilling down to more granular levels,” explains Brager. “How are price tiers performing across various product segments within wine and spirits, and how big are those segments? For instance, luxury price tier volume share for spirits overall might be relatively low, but it’s much higher for certain segments like Tequila, Scotch, and Cognac. How does that look further into individual channels and sub-channels or by geographic areas across the country? And by looking at the latest three months, for example, companies can determine whether the trend is getting better or worse over that shorter period of time compared to the longer twelve-month trend.”

For members of the media who wish to discuss PTP data with a SipSource analyst, please contact Michael@WSWA.org.

For professionals interested in subscribing to this SipSource data set, please contact Nicole@wswa.org.

About SipSource by WSWA

Wine & Spirits Wholesalers of America’s (WSWA’s) SipSource is the ONLY source for aggregated distributor depletion data, built from unique items sold to individual stores. Since wholesalers distribute to all types of retailers, SipSource has unrivaled channel segmentation. It also covers the largest volume of bona fide alcohol sales and does not need to rely on estimates, samples or projections. WSWA’s SipSource uses an industry leading platform: VIP’s iDIG to deliver timely, transparent and trusted data. In addition to the reporting tool, subscribers have access to quarterly and annual reports that leverage powerful collaboration with industry leaders and provide high-level insights into the wine and spirits marketplace.

###