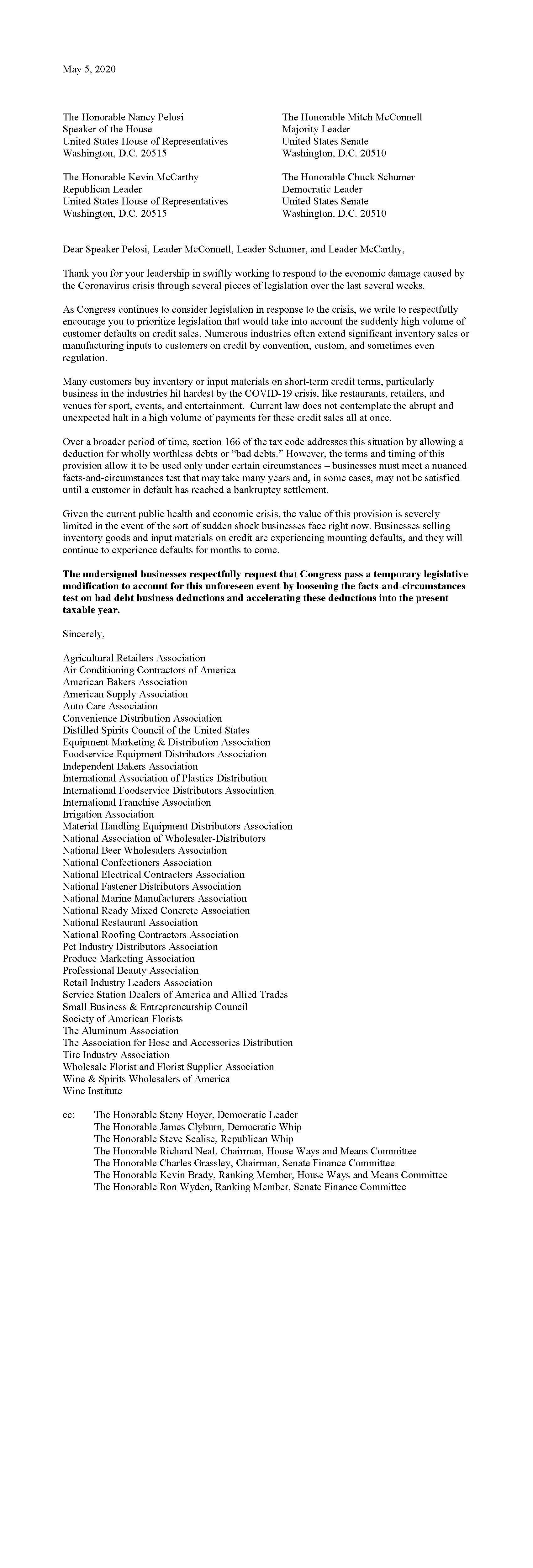

Today, Wine & Spirit Wholesalers of America joined nearly 40 other industry associations in sending a letter to Congressional Leadership encouraging them to prioritize legislation that would take into account the suddenly high volume of customer defaults on credit sales.

Many customers buy inventory or input materials on short-term credit terms, particularly businesses in the industries hit hardest by the COVID-19 crisis, like restaurants, retailers, and venues for sport, events, and entertainment.

A recent study by economists at John Dunham & Associates estimates that America’s wine and spirit wholesalers can expect to lose up to $921.4 million in uncollectible or difficult-to-collect receivables alone due to on-premise closures.

Current law does not take into consideration such an abrupt and skyrocketing volume of defaults on credit sales due to unforseen crises. The coalition respectfully urged Congress to pass a temporary legislative modification to account for this unforeseen event by loosening the facts-and-circumstances test on bad debt business deductions and accelerating the deductions of "bad debts" into the present taxable year.

You can download the letter in full here.