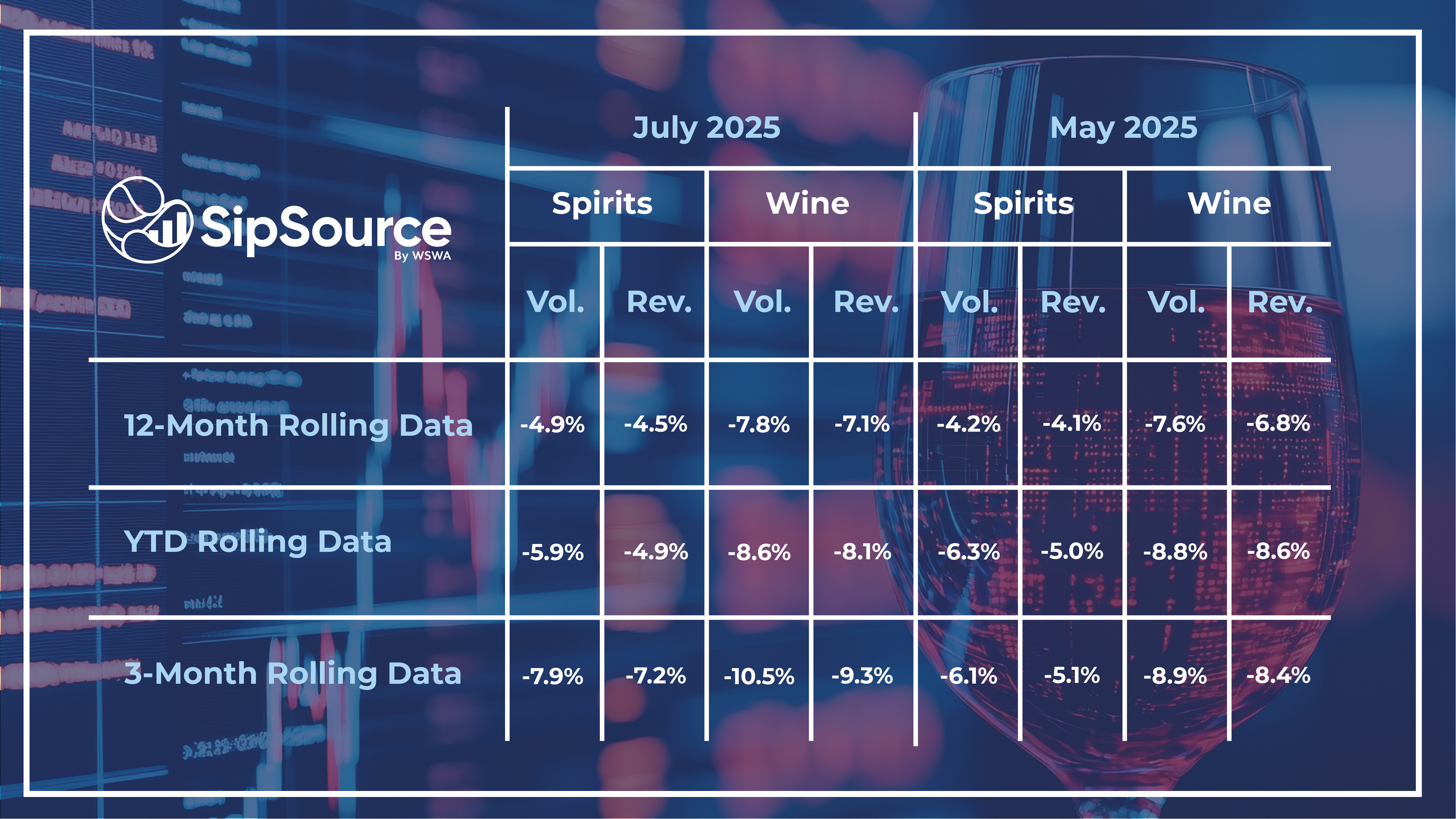

July offered a modest reprieve in depletion trends, but results aren’t strong enough to shift the longer-term trajectory of the industry. Spirits finished the month down -4.9% in volume and -4.6% in revenue, while wine performed worse, declining -8.8% in volume and -6.9% in revenue. While these numbers aren’t catastrophic, they lack the momentum to counteract the extraordinarily weak results from May, which continue to weigh heavily on the rolling three-month figures.

Another concerning indicator is the steady decline in PODs (points of distribution). Each month, PODs have continued to contract, suggesting that fewer brands are finding or maintaining shelf space. This has longer-term implications for category health, as diminished visibility directly impacts consumer access and engagement.

Looking ahead, August presents a particularly tricky landscape. With one fewer shipping day but easier year-over-year comparisons, August has the potential to stabilize results. In August 2024 Spirits fell -10.5% in volume and -10.4% in revenue, while wine slipped -12.3% in volume and -12.5% in revenue. These results underscore the persistent headwinds facing both categories as the industry moves into the critical final five months of 2025.

The comparative outlook for the August–December 2025 stretch highlights different levels of challenge for spirits and wine. Spirits face more difficult comparisons, with last year’s period already down -3.9% in volume and -4.2% in revenue. Wine, on the other hand, has softer results to compare against, with the same five months showing -7.4% in volume and -6.8% in revenue. That dynamic sets up the possibility that spirits may struggle more than wine to post growth as 2025 closes out.

Within this broad landscape, several product classes stand out as ones to watch. Irish Whiskey surged in July, with depletions up +17.8%, raising the question of whether this growth is translating to stronger consumer takeout. Tequila/Agave, once the dominant growth story, has slowed considerably, posting just +0.1% growth over the last six months. Whether the segment can sustain its momentum is an open question. Meanwhile, Champagne has quietly built strength, rising +8.4% over the last six months, signaling renewed consumer interest in celebratory and premium occasions.

As summer turns to fall, the industry faces a mix of pressures and opportunities. Weak comparisons may offer some relief, but sustained volume and revenue recovery will depend on how consumers respond to shifts in category performance and product innovation.