May SipSource results landed softer than anticipated, driven in part by one fewer shipping day compared to May 2024. However, even accounting for that, the magnitude of the decline was sharper than expected. Spirits were down -13.1% in volume and -11.9% in revenue, while wine saw an even deeper dip at -14.3% in volume and -13.8% in revenue.

Is Premiumization Returning to Home Bars?

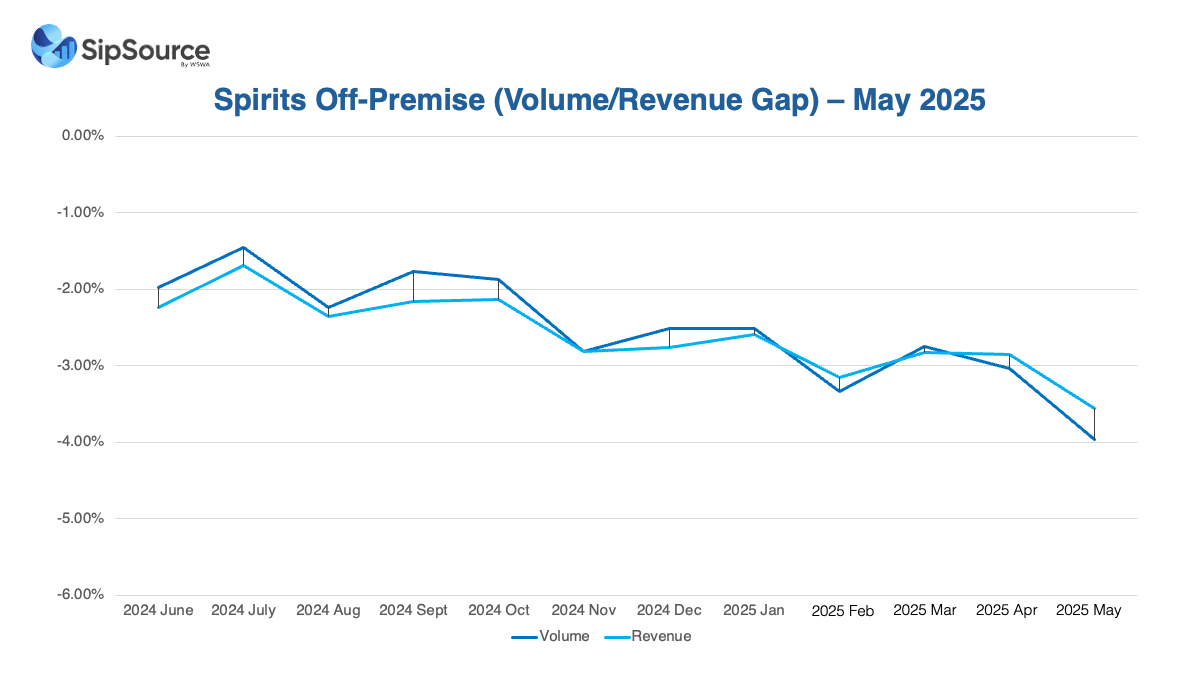

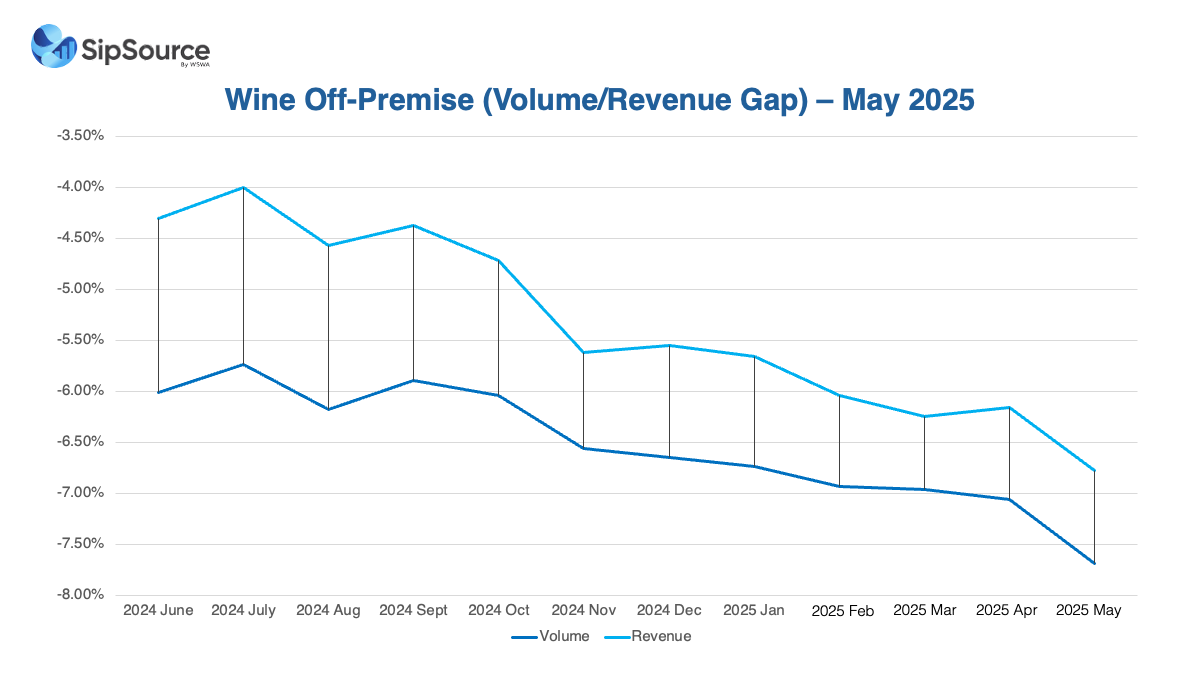

Despite the broader weakness, there are early signs that premiumization may be making a modest return, particularly in the off-premise channel. In spirits, the revenue/volume trend gap—an indicator of pricing and mix strength—was +20 basis points off-premise but declined -50 basis points on-premise. For wine, the gap was even more notable: +80 basis points off-premise and -30 basis points on-premise, suggesting consumers may be leaning into quality purchases when shopping retail, but trading down when dining or drinking out.

What’s Next?

Looking ahead, June 2025 results are expected to show some recovery thanks to the benefit of an additional shipping day. This should help offset some of May’s softness, though it won’t be enough to significantly change the trajectory of the 12-month trend lines, which continue to show year-over-year deterioration.

The bottom line is that trends remain weaker than they were at this time last year. As we move into the next four months—June through September—the comparison base (or “comps”) becomes more favorable for wine and more difficult for spirits. In 2024, the June–September period showed a -3.6% volume and -4.4% revenue decline for spirits, while wine posted an -8.2% volume and -7.1% revenue decline. These figures set the stage for potentially better performance in wine relative to spirits through the end of Q3.

Segments to Watch

According to SipSource analysts, in terms of segments to watch, Cognac has shown signs of stabilizing and could benefit from very weak year-ago comps in the coming months. Tequila—particularly Añejo—has seen highly volatile short-term trends, ranging from +23.8% growth to -22.9% declines over the past five months. Meanwhile, imported Champagne and sparkling wine have shown improvement, suggesting some resilience in celebratory or luxury categories.

While the overall environment remains challenged, there are nuanced signals worth watching as we track the mid-year trajectory of both wine and spirits.