June closed out the first half of 2025 on a soft note, according to the latest industry data from SipSource. Both the spirits and wine categories posted significant declines despite the benefit of one additional shipping day. SipSource depletion data revealed that spirits fell -5.8% in volume and -5.7% in revenue for the month, while wine posted an even steeper drop of -8.8% in volume and -8.1% in revenue.

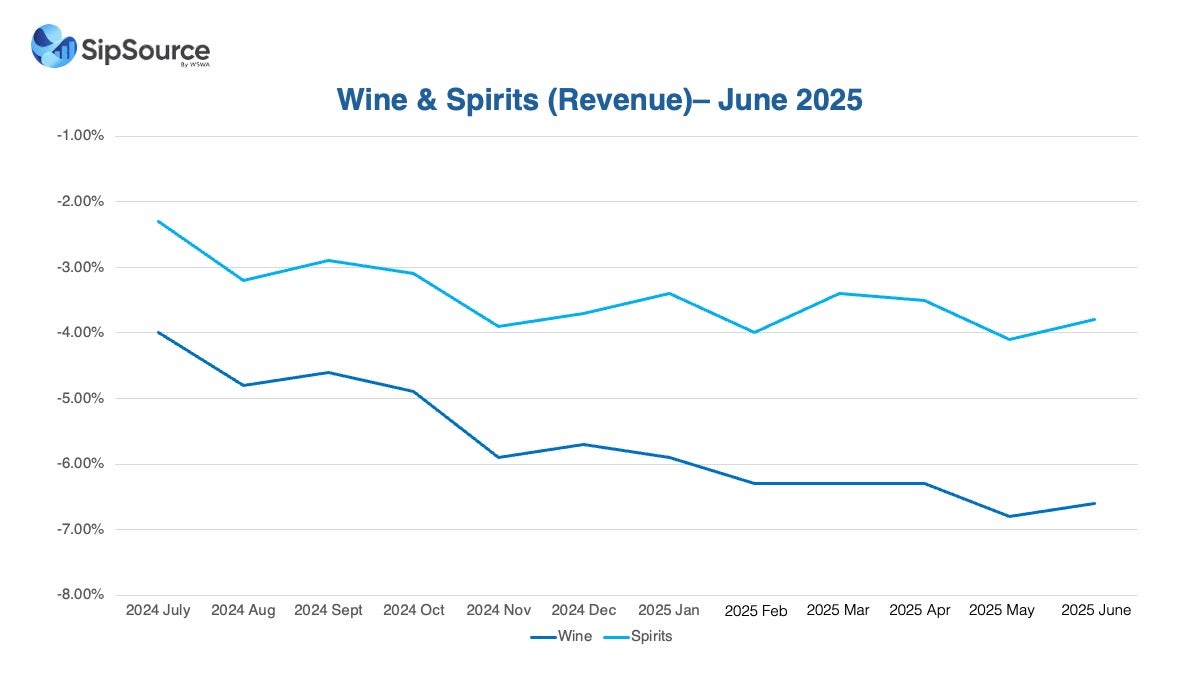

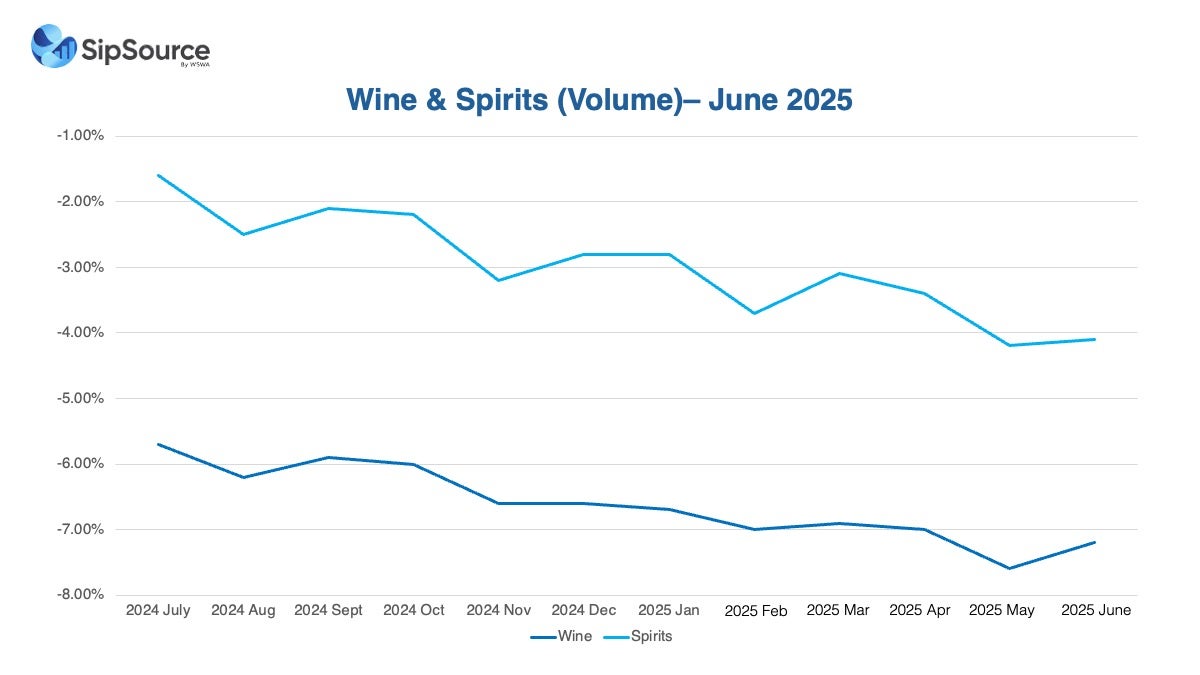

These figures contribute to what has been a notably challenging year. SipSource’s year-to-date tracking shows that through the first six months of 2025, spirits are down -6.0% in volume and -5.0% in revenue, while wine has declined -8.7% in volume and -8.5% in revenue. The sustained softness across both categories reflects ongoing demand pressure and evolving consumer preferences that are reshaping the landscape.

Looking ahead to July, SipSource anticipates a slight stabilization in negative territory, though conditions remain fragile. July 2025 aligns with July 2024 in terms of shipping days, but last year’s numbers were inflated due to two extra shipping days compared to 2023. This anomaly makes year-over-year comparisons challenging. That headwind will persist as the industry moves into Q3. For the July through September period of 2024, SipSource reported spirits were down -2.6% in volume and -2.8% in revenue, while wine declined -6.5% in volume and -5.7% in revenue. With those figures as the comparative baseline, even maintaining current trends will prove difficult.

Despite the tough environment, SipSource continues to identify bright spots in the marketplace. Cognac volumes have shown consistent improvement over recent months, indicating the potential for continued recovery. Bourbon is also showing signs of stabilization, particularly in the $20–$29 price segment—a positive signal that consumers may be returning to core offerings after a period of premiumization. In the wine space, Champagne stands out as a category with strong momentum, up +8.4% year-to-date according to SipSource data. Whether this growth can be sustained through the remainder of 2025 remains uncertain.

While macro conditions remain difficult, SipSource insights highlight several opportunities in emerging trends and resilient product segments. As we move into the second half of the year, SipSource will continue to deliver timely, data-driven updates to help industry stakeholders plan, adjust, and evaluate performance with confidence.